maryland digital ad tax bill

Larry Hogan that make major changes in the states tax code. 3 Entities having annual gross revenues derived from digital advertising services in Maryland of at least 1 million in a.

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities Salt Savvy

On February 12 2021 the Maryland General Assembly voted to override Governor Larry Hogans veto of HB.

. The succinct three-page bill which will be cross-filed in the House of Delegates by Majority Leader Eric G. Its expected to generate 250 million in its first year. As the Maryland Senate voted 29-17 and the Maryland House of Delegates voted 88-48 the bill received the required three-fifths vote by both chambers of the Maryland General Assembly to.

1 By enacting HB. A person who derives gross revenues from digital advertising services in the state may not directly pass on. The first-in-the-nation digital advertising tax is postponed for one year until 2022 while the state prepares regulations and guidance.

732 which creates an entirely new gross revenues tax on digital advertising services. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of Maryland. One of the provisions the Act states that the applicability of the Digital Advertising Gross.

This page contains the information you need to understand file and pay any DAGRT owed. Imposition of tax Enacted by the state legislature in February 2021 following an override of a veto by Maryland Gov. 12 2021 Marylands General Assembly enacted two bills over the veto of Gov.

One is a sales tax on digital products and the other is a digital advertising tax. 732 Maryland is poised to become the first state to impose a gross receipts tax on proceeds from digital advertising services. Although the bill ostensibly targets large technology companies and advertising.

Specifically effective for tax years beginning on or after December 31 2020 a new tax would be imposed on annual gross revenues derived from digital advertising services in. The Maryland law lays out a vague and ambiguous apportionment formula that provides that the part of a persons annual gross revenues derived from digital advertising services in the state shall be determined using a fraction the numerator of which is the annual gross revenues of a person derived from digital advertising services in the state and the. This tax is the first of its kind.

House Bill 732 imposes a new tax on the gross revenues of a person derived from digital advertising services in Maryland. Review the latest information explaining the Comptroller of Marylands. State Local Tax SALT On Feb.

The District of Columbia jumped on the digital ad tax bandwagon in 2020 but jumped off after discovering a problem with its proposal. Maryland Senate Bill SB 787 became law 30 days after being presented to the governor who allowed the bill to pass without his signature. Digital advertising services includes advertisement services on a digital interface including advertisements in the form of banner advertising search engine advertising interstitial advertising and other comparable.

Hogan Vetoes Maryland Digital Advertising Tax Legislation. The Maryland Legislature has adopted the first digital advertising tax in the nation. Importantly Senate Bill 787 would push the effective date of the tax on gross revenues from digital advertising services to tax years beginning after December 31 2021.

Connecticut Indiana Massachusetts Montana New York Texas Washington and West Virginia all introduced digital advertising tax bills in 2021. Revises Guidance For Sales Tax Of Digital Products. Maryland Delays Digital Advertising Services Tax.

The substance of the bill is a single sentence. See SB 787 for more details. The Maryland legislature recently voted to override the veto of two tax bills HB.

732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital advertising revenues pulled in by large companies. One of the currently-enrolled proposals House Bill 732 was amended to include provisions previously included in standalone bills imposing a tax on digital advertising gross revenues. Digital advertising services Tax Alert Overview On February 12 2021 the Maryland Senate following the House of Delegates earlier in the week voted to override the veto of Governor Larry Hogan to House Bill 732 resulting in the enactment of a new gross revenues tax on digital advertising services in Maryland.

932 expands the existing sales and use tax base to include digital products effective March 14. The first-in-the-nation digital advertising tax is postponed for one year until 2022 while the state prepares regulations and guidance. The tax would be imposed on entities with global gross revenue of.

The first bill HB. For instance a company subject to the 10 rate having 100 million of revenue attributable to the performance of digital advertising services in Maryland would owe an annual tax of 10 million. Legislation is pending in Maryland Senate Bill 787 that revises tax laws enacted earlier this year when the General Assembly overrode vetoes of two 2020 bills.

Luedtke D-Montgomery on Monday would also exempt broadcasters and news media from paying the tax. Currently the tax is effective for tax years beginning after. Applicability Date of Digital Advertising Gross Revenues Tax Delayed On April 12 2021 the General Assembly of Maryland passed Senate Bill 787 an Act concerning Digital Advertising Gross Revenues Income Sales and Use and Tobacco Taxes Alterations and Implementation.

932 which were vetoed by Gov. Lawmakers approved House Bill 732 in March 2020 but Governor Larry Hogan vetoed it. Overriding the governors veto of HB.

Larry Hogan the digital advertising services tax is imposed on entities with global gross revenues of at least 100 million. Kent DeBruin Manager State and Local Tax. To date Maryland is the only US.

Larry Hogan in May 2020. Larry Hogan R vetoed a proposed first-in-the-nation digital advertising tax that would have imposed rates of up to 10 percent on digital advertising served to Marylanders. State with a tax on digital advertising.

The Maryland digital advertising taxapplied to gross revenue derived from digital advertising serviceshas a rate escalating from 25 percent to 10 percent of the advertising platforms assessable base based on their annual gross revenues from all sources ie not just digital advertising and not just in Maryland. House Bill 732.

Exposed Get Your Walking Dead Reps To Take Action Online Branding Take Action House Party

Maryland Maryland North America Continent Historical Sites

Hogan Democratic Leaders Agree On Tax Relief Packages The Washington Informer

Maryland Gas Tax Hike Imminent Franchot Urged To Take Action

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Amazon Facebook Google Back Lawsuit Against Maryland S New Online Ad Tax The Washington Post

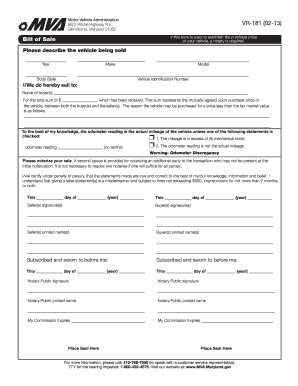

Mva Md Fill Out And Sign Printable Pdf Template Signnow

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Digital Goods Now Taxable In Maryland Taxjar

Governor Hogan Enacts Largest Tax Cut Package In State History Retirement Tax Elimination Act Becomes Law The Southern Maryland Chronicle

With Override Votes Md Senate Passes Landmark Education Reform And Digital Ad Tax Bills Into Law Wtop News

Check Me Out On Foxnews Com Real Estate Clifton Marine

Maryland Enacts New Sales Tax On Digital Goods And Services Sc H Group